Interview of the Month: David Craig, TNFD

This month, SFG had the pleasure of speaking to David Craig, the Co-Chair of the Task Force for Nature-Related Financial Disclosures (TNFD). He shared more information on the uptake of the voluntary framework since its launch in 2023, what they are doing to address data and capacity gaps, and how nature-related assessments and disclosures are helping businesses to innovate, reduce costs, access new markets and identify new investment opportunities.

TNFD is a voluntary framework, yet over 500 organizations including 25% of the world’s systemically important banks (GSIBs) committed to nature-related disclosures. This is a fantastic start, was this what you expected when the framework launched? What are your expectations for growth in the future? How do you plan to deepen engagement with the financial sector in nature-related disclosures?

When the TNFD released the final recommendations in September 2023, we hoped that market uptake would progress at pace. There is growing recognition of the importance of nature and biodiversity for business and finance – nature risk is already sitting on balance sheets, in cashflows and in portfolios from small enterprises to multinationals and global investors. The voluntary commitment to report aligned with TNFD is a public acknowledgement that those investors and companies are taking nature risks seriously.

Those nature risks are emerging globally and across value chains, and market participants need to understand how these impact their business. Business models, supply chains and long-term performance rely on ecosystem services such as freshwater provision and pollinator services. Companies that fail to assess and manage risks face potential operational, supply chain, financial and reputational impacts – such as those described in Bloomberg NEF’s 2023 report When the Bee Stings. Companies that have moved early to try to identify, assess and quantify their nature-related issues are better equipped to manage these risks and able to unlock new opportunities.

We expect the number of Adopters to continue to grow. Already, in addition to the 500+ Adopters that have publicly committed to adoption as of COP16 in October 2024, we are aware of many more companies and financial institutions that are using the LEAP approach and assessing their nature-related issues, but not communicating publicly. As companies and financial institutions learn more about the risks existing already in their business’s interfaces with nature – as well as the opportunities the emerge when a business understands those – we are confident that organisations will continue starting on the assessment and committing to disclosure of nature-related issues, in order to increase the resilience of their business.

What do you see as the biggest hurdles for widespread corporate adoption of TNFD recommendations, and how can these barriers be addressed?

Over the past years, since TNFD was established in 2021, we have heard and responded to many concerns from the market, including during the nearly two-year design and development phase of building the recommendations. To answer many of those questions, TNFD has continued to create and build out guidance for the market, including sector-specific guidance and guidance on elements of nature-related assessment and disclosure like scenario analysis, engagement with stakeholders, transition planning and more.

Currently, TNFD is turning its attention to challenges around data, based on market feedback highlighting concerns around the quality, comparability and assurability of nature-related data, as well as the high cost overhead associated with understanding which data is relevant and sourcing it. The data exists, and new innovations are developed all the time, in areas of measurement and analytics. There is a lot of data out there; the challenge exists in how to collect it, piece it together and understand it so that it leads to business intelligence. In order to address these challenges and meet data-related needs, the TNFD proposes a roadmap to help catalyse a step change in investment into the nature data value chain and improve the accessibility issues for downstream users. A pilot programme is now underway until September 2025, designed to generate practical insights to help strengthen the nature-related data value chain (NDVC) and inform the development of TNFD’s proposed open-access Nature Data Public Facility (NDPF).

Another major hurdle for many is a lack of resources, capacity or understanding of nature-related issues. Gaps in market knowledge and skills, as well as a fear of the unknown, may keep organisations from feeling confident enough to begin their nature-related assessments and disclosures. Through over 200 pilots, many companies have found that once they start, nature-related assessments are more intuitive than expected. The TNFD has focused recently on improving its capacity-building offerings, including by releasing two new tools earlier this year: TNFD’s Learning Lab, for individual self-paced learning, and the Trainer Portal, which provides resources for third-party trainers. Getting started and then working to build ambition is key.

With TNFD launching two new capacity-building tools targeted at market participants and third-party trainers, what gaps in market knowledge or skills are you aiming to close, and how do you expect these tools to accelerate TNFD adoption?

Between all of TNFD’s capacity-building tools and resources, we aim to help those at any level of maturity on nature-related issues, in any geography and across departments and seniority levels understand the importance of nature-related assessments and how to get started. Key in addressing knowledge gaps is the creation of consistency and alignment, through foundational content and the development of shared language and shared understanding of nature. The materials answer the ‘why’, ‘what’ and ‘how’, enabling the market to act.

The Learning Lab is a self-guided set of modules covering all aspects of the TNFD recommendations and guidance, created for professionals operating at all levels to learn at their own pace. Meanwhile, the Trainer Portal provides materials to be used in training and education programmes on nature-related issues and the TNFD recommendations and guidance. White label materials have been designed to be adapted by training providers, educational institutions and consultants.

Are you anticipating any changes in the way the private sector engages with the nature topic given recent political shifts and their possible influence on global environmental policies and agreements?

In the past few months, we’ve seen some trends such as a general anti-ESG sentiment and changes like the EU’s Omnibus simplification package. However, TNFD responds to a more fundamental question around risk management and long-term financial and business resilience. Despite what regulation may or may not exist, TNFD adoption and reporting continues, because market participants are understanding that nature risk already exists in their business models. Not understanding that risk through assessment of nature-related issues will damage business resilience. Investors are also recognising this, and we are aware of over 15 asset owners and investors calling for nature-related disclosures, and some referencing TNFD, in addition to many joining global investor groups such as PRI Spring and Nature Action 100.

Businesses are also discovering opportunities through their nature-related assessments and disclosures, helping businesses to innovate, reduce costs, access new markets and identify new investment and transition opportunities. In 2024, the World Economic Forum estimated that the global market for nature-based solutions is projected to reach USD 800 billion by 2030, presenting major commercial opportunities. New products and innovations are emerging in fields such as new materials, recycling, waste disposal, alternative chemicals and natural products and packaging, shown in Bloomberg NEF’s report Opportunity Blossoms (Oct 2024). Choosing to undertake TNFD-aligned assessment and disclosures is not only about regulation, but about intelligent business decisions which also work towards a nature-positive future.

We know that nature and climate are two sides to the same coin, but they are often segmented in business processes. How do you see the links between nature and climate when it comes to disclosure? Are there direct links between the TNFD and the TCFD?

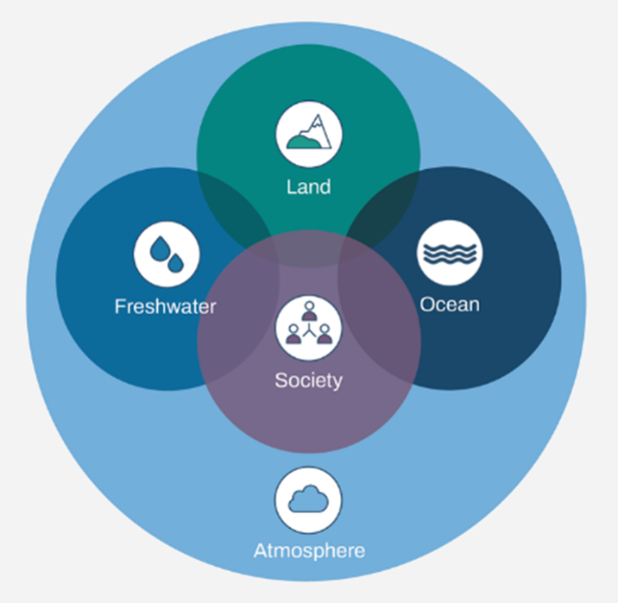

Nature and climate are both part of the overall natural world. They are impossible to separate in the natural world, and TNFD encourages organisations to consider them together. TNFD’s work follows an integrated climate and nature approach: it builds on the idea of the natural system as four nature realms including atmosphere, land, ocean and freshwater.

TNFD also encourages integrated reporting by building the TNFD recommendations on the TCFD recommendations. All eleven of the TCFD’s recommended disclosures have been carried over to the TNFD recommendations, with three additional disclosures included in TNFD to cover nature-specific considerations: engagement with Indigenous Peoples, local communities and affected stakeholders; interface with priority locations; and value chains.

We’ve heard as well from many first generation TNFD Adopters and reporters that building on the links between climate and nature, or TCFD and TNFD, makes reporting easier. We already see some reporters publishing TNFD-aligned disclosures within integrated or annual reports, alongside their climate reporting.