Update from SWISOX

Building the Marketplace Sustainable Finance Actually Needs

Over the past year, SWISOX has been operating quietly but with a clear objective: to lay the foundation for infrastructure that can support a credible, scalable, and future-proof marketplace for sustainable finance. One that aligns with the ambition of the global climate agenda and the broader goals of sustainable development.

While many efforts in sustainable finance focus on improving disclosure frameworks, updating ESG scores, or enhancing data platforms, the approach SWISOX is taking is different. They are building something concrete: a functional marketplace that enables the listing and financing of companies and bonds that genuinely contribute to environmental and social goals.

This system is designed to enable capital to flow confidently into companies that meet clear sustainability criteria.

But getting there is not simple. The journey requires multiple moving pieces to align:

- First, the need for sustainable products that appeal to both institutional and retail investors — and that begins with clearly defining what counts as a sustainable company or bond.

- At the same time, the need to scale taxonomy-based reporting so that there is sufficient, comparable, and verifiable data to assess companies in the first place.

- And finally, the need for tools and digital infrastructure that are intuitive and engaging enough to attract the next generation of investors — particularly those who care about the environmental and social impact of the companies they support.

Each of these components demands time, coordination, and trust. But, when they come together, the result will be a marketplace that meets both the credibility requirements of institutional capital and the clarity needs of retail investors.

Today, SFG and SWISOX are pleased to share a first public update on this journey with the SFG community, whose support and insights have helped shape this work from the very beginning.

⸻

From ESG Labels to Regulatory Alignment

SWISOX’s work begins with a foundational question: what qualifies as a sustainable company?

Rather than create a new ESG score or duplicate efforts already underway, SWISOX turned to the most advanced, science-based frameworks currently available — starting with the taxonomy-based systems developed under the EU Sustainable Finance agenda.

This framework, now used by thousands of companies across Europe and increasingly mirrored in more than 50 jurisdictions worldwide, offers a clear regulatory definition of what economic activities can be considered environmentally sustainable. It moves beyond ratings and into objective, verifiable classification.

They’ve translated this policy architecture into a usable, public-facing classification system — the Traffic Light™ System. It’s built for transparency, simplicity, and alignment with regulation, designed to help investors, policymakers, and the public understand which companies meet the highest sustainability standards.

Today, SWISOX is launching the first step in this system: the Green Light List.

⸻

What qualifies a company for the Green Light List?

To be included in the Green Light List, companies must meet strict, evidence-based criteria:

- At least 55% of their revenue must come from activities that align with the EU Taxonomy for Sustainable Activities.

- They must comply with Paris-Aligned Benchmark–inspired exclusions, including:

-

- No revenue from coal or oil

- No involvement in tobacco or controversial weapons

- No new or ongoing fossil fuel infrastructure projects

These are minimum standards and are subject to refinement as scientific understanding and regulatory benchmarks evolve.

The full SWISOX methodology is openly accessible and has been designed to evolve. As standards tighten and technologies shift, so will the thresholds. Ongoing review and feedback is welcome from the financial, academic, NGO, and policy communities.

🔗 https://studio.swisox.com/methodology

⸻

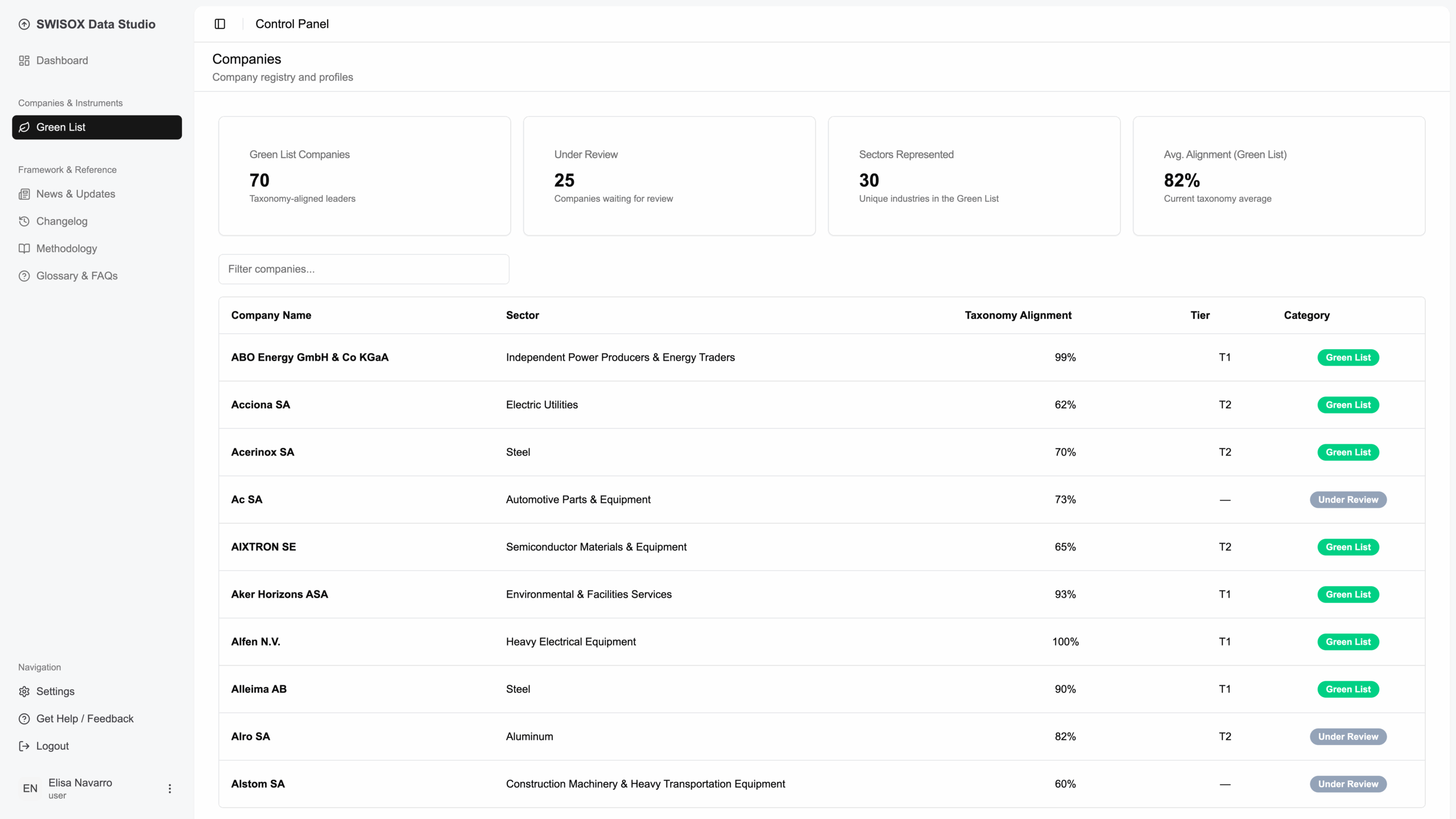

A First Output: Over 70 Companies Identified

Using this framework, SWISOX has identified an initial cohort of more than 70 companies from around the world that meet the criteria for Green Light status.

These companies are now publicly listed and accessible through an always-free platform. Simply create an account at traffic.swisox.com — your entry point to the SWISOX Data Studio, where you’ll find the full methodology, the complete Green Light List, and companies currently under review or not yet meeting the criteria.

And this is only the beginning. Coming soon to the Studio:

- Access to companies’ latest sustainability reports

- Live portfolio pricing for the Green Light List (currently displayed with a short delay)

- Feedback tools to allow the community to challenge assumptions and contribute to ongoing refinement

In the months ahead, SWISOX will continue expanding the list — with a particular focus on companies from emerging markets, developing economies, and SMEs. Many of these actors remain invisible to mainstream sustainable investors, despite meeting — or exceeding — key sustainability criteria.

This work can help shift that dynamic.

⸻

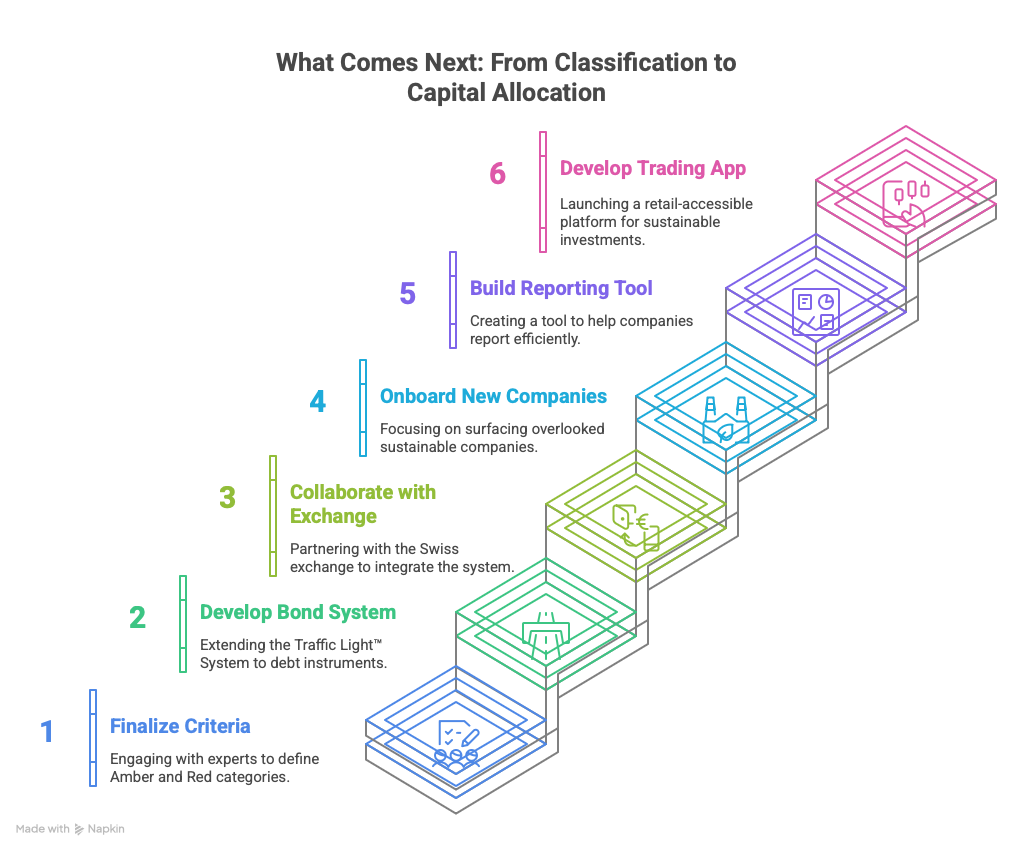

What Comes Next: From Classification to Capital Allocation

The Green Light List is the first public output of our Traffic Light™ System — but it’s only the foundation. SWISOX’s broader mission is to build the full infrastructure for a functional, scalable marketplace for sustainability-aligned finance.

Over the coming months, SWISOX will:

Finalize and consult on criteria for Amber and Red categories

The team is currently engaging with civil society organizations and technical experts to determine what qualifies as credible transition (Amber) and what should be excluded from sustainable finance (Red). The first drafts will be released for public consultation soon. If you’d like to contribute, SWISOX welcomes your input.

Develop a classification system for sustainable bonds

SWISOX will extend the Traffic Light™ System to cover debt instruments, enabling investors and issuers to apply the same taxonomy-based logic to fixed income products. This work is already underway.

Collaborate with the Swiss stock exchange

SWISOX is working with the Swiss exchange to explore how the Traffic Light™ System can support classification and visibility for sustainability-aligned companies within their ecosystem. This partnership aims to embed taxonomy-based screening into existing listing frameworks — bringing greater clarity to investors and enhancing the credibility of sustainability claims at the exchange level.

Continue onboarding new companies into the Studio

The team’s focus remains on surfacing overlooked sustainable companies, especially from emerging markets, developing economies, and SMEs — actors who often meet core criteria but lack visibility.

Build the next-generation reporting assistant for companies

SWISOX has started work on a tool to help companies — especially SMEs — navigate and report under taxonomy-based systems more efficiently. The project will be developed in partnership with trusted actors in academia and finance. More to come on this soon.

Develop a digital investment platform

This summer, development of the SWISOX trading app will begin. This is a retail-accessible platform designed to offer direct exposure to companies and instruments that meet the SWISOX classification. This marks the first step toward enabling a true sustainability-aligned capital market.

⸻

While further details will follow later this year, the direction is clear: SWISOX is building the ecosystem required to move from sustainability ambition to credible capital allocation.

Built in Geneva. Made for the world.

Want to follow SWISOX’s progress, collaborate , or ask questions?

The shift from ESG scores to taxonomy-based classification is not just a technical upgrade — it’s a cultural shift. And the SWISOX team believes it should be collaborative.

Whether you’re a company seeking to understand your alignment, a policymaker working on regulatory convergence, or an investor looking to go deeper — SWISOX invites you to connect:

• Explore the Traffic Light™ System and view the Green Light List: traffic.swisox.com

• Access the full dataset, methodology, and company-level filters: studio.swisox.com

• Follow our updates on LinkedIn or via our Finance Without Greenwashing newsletter

Contact: Dawid Bastiat, CEO of SWISOX. Email: